The three main psychological emotions commonly encountered in trading are greed, entanglement, and fear. Investors need a strong trading psychological system to control and even utilize the above three emotions at different stages. So, what are the points to be achieved in building a complete trading psychological system?

Reasonable psychological expectations

Before trading, it is necessary to have an overall expectation of the future, including market expectations and target psychological expectations. Market expectations refer to having a clear goal for the market's position and future direction, while target expectations refer to the trading opportunities and risk status of the target at its current position. Without the above psychological foundation, there is nothing to talk about.

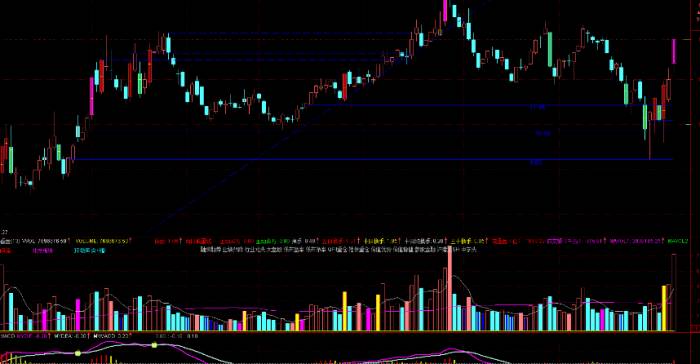

For example, in the first half of 2014, the domestic stock market was sluggish. We abandoned the mentality of inaction and eagerness for quick success, and took a light position to buy futures contracts when the market was low and held them in the medium term. In July, the stock market came out of the bottom, which further verified that our expectations were in line with the overall market direction. Therefore, we decisively increased our positions in futures contracts and held them until, after half a year of persistence, we welcomed a surge of 60%, with substantial profits. Although we did not completely step on the market rhythm and maximize profits, our psychological expectations were reasonable and basically in line with the overall market direction, thus avoiding greed, entanglement, and fear, staying away from unexpected risks, and achieving expected returns.

Advertisement

Open-minded trading mentality

Real-time operation is the core test stage of trading psychology. The entire trading process should be: calmly building positions, patiently waiting, rational analysis, and decisive operations. In trading, when encountering problems, it is necessary to first control the mentality and emotions, but many traders are not. Because of eagerness, worry, greed, and fear, their trading plans are often "deformed," and in the end, they waste a lot of time and energy, but the effect is not good.

Summarizing the trading process, most traders often encounter the following psychological issues:

First, the mentality of excessive speculation is serious. Investment is the process of wealth appreciation, but many people regard it as a shortcut to get rich quickly, thus turning investment into gambling.Secondly, they give up on familiar industries and targets, blindly follow trends, and compare themselves with others, failing to adhere to trading principles.

Thirdly, they frequently change their trading plans. As soon as the target fluctuates slightly, they constantly adjust, which results in a deteriorated mindset.

Fourthly, they pay too much attention to profits and losses, neglecting the trading itself. Only by respecting the trend of the target and formulating corresponding strategies can they improve their trading. Otherwise, they may be impatient or under pressure, unable to withstand fluctuations and hastily exit, thus missing opportunities or failing to stop losses decisively.

Fifthly, they cannot think independently and follow the crowd excessively. The truth is often in the hands of a few, so it is necessary to think and judge independently.

Sixthly, they cannot go with the trend. Some traders rigidly apply the investment logic of "when others are fearful, I am greedy," deliberately looking for a decline when the market is rising and for a rise when the market is falling. However, in general, whether it is a big rise or a big fall, they ultimately cannot hold on to profits and fall into a mental vortex they set themselves and cannot extricate themselves.

Seventhly, they cannot stand loneliness and are fickle. In a trend market, most targets have their own expectations and rhythms. As long as the trend has not changed and the technical aspects support it, try not to switch targets frequently.

Eighthly, they pursue certainty and perfection one-sidedly. Trading itself is full of various possibilities, and most people can only try to improve certainty as much as possible. Excessive pursuit of perfection is not worth it. Trading itself is a continuous process of self-cultivation, and excessive pursuit of perfection can lead to a sense of frustration, which directly affects normal judgment and analysis.

Strict operational discipline

Generally speaking, traders have their own operational discipline, but the key is to see their execution. Before operating, traders should set upper and lower limits for their psychological expectations. When reaching the upper limit, they should at least partially take profits and leave some positions to observe and exit at any time; when breaking through the lower limit, they should resolutely stop losses and exit, and then as onlookers, carefully evaluate and analyze the market again, and re-enter at the right time. The most taboo is to continuously revise their psychological expectation lower limit, and finally find that the result is far beyond their initial expectation, thus falling into a greater passivity.

In summary, the whole process of actual trading is a continuous process of analysis, correction, and execution. There is not much time for trading, but more tracking and patience. This is a comprehensive process of examining mentality and testing human nature. All the habits of traders will be fully displayed and magnified in the trading process. Only by continuously learning and summarizing lessons, constantly tempering, and overcoming the common thinking and psychological weaknesses of human nature, can one become an excellent trader.

LEAVE A COMMENT